Why are UK mortgages going up and should buyers hold off?

Reports indicate UK mortgages are increasing. Woman&home asked an expert for their advice

UK mortgages are getting more expensive, according to some reports, which may present a concern to any current homeowners or those in the market to invest.

Homes are a lot more than bricks and mortar—they're the places we make memories with our families, places we grow into and out of. However, they're also one of the biggest investments you'll make in your life. As the energy crisis rages on, many have legitimate concerns about soaring utility bills without even contemplating the issue of a mortgage.

In order to get a better idea of what's happening, woman&home spoke to Colby Short, the founder, and CEO of GetAgent.co.uk—an online estate agent comparison company.

"Just like everything of late, mortgage rates have seen a sharp spike. As with supermarkets, energy bills, and petrol costs, rising inflation has made its mark on interest rates and mortgages," says Colby. "Inflation is running at 3.2% and rising, and while the banks are keeping an eye on the situation, they may need to increase the base rate in 2022."

As the base rate is set by the Bank of England and acts as a benchmark for borrowing, a lower base rate means lower interest rates too. In other words, when the base rate rises, so will mortgage interest rates. "The price of mortgages partly reflects this base rate," he explains.

Colby continues, "In September, the Bank of England agreed to keep the base rate at .01% to help control the aftermath of the Covid 19 Pandemic. However, judging from the minutes of the meeting held on September 23, there were clues to suggest that either rate cuts or rises are on the way."

With the rates of inflation rising, the base rate will likely increase. However, Colby explains that homeowners could, "hedge this by taking out a fixed-rate mortgage which is currently cheaper."

Sign up for the woman&home newsletter

Sign up to our free daily email for the latest royal and entertainment news, interesting opinion, expert advice on styling and beauty trends, and no-nonsense guides to the health and wellness questions you want answered.

The rise in mortgage rates is meeting an increase in demand for housing, with a trend towards rural living and more living space. As demand has soared alongside a lack of stock and the stamp duty holiday ending—house prices have surged.

"Average house prices are up," says Colby. "With the average home in the UK now worth £248,742."

The main thing to remember is the enormous decision that buying or selling a home really is. There’s a lot of things to consider beforehand and not everything’s in your control.

"Some things, like your personal life, financial situation, and the time of year you decide to buy or sell, are manageable," says Colby. "But other factors, like Stamp Duty thresholds, the mortgage guarantee scheme, interest rates, and house prices, are completely out of your hands."

Aoife is an Irish journalist and writer with a background in creative writing, comedy, and TV production.

Formerly woman&home's junior news editor and a contributing writer at Bustle, her words can be found in the Metro, Huffpost, Delicious, Imperica and EVOKE.

Her poetry features in the Queer Life, Queer Love anthology.

Outside of work you might bump into her at a garden center, charity shop, yoga studio, lifting heavy weights, or (most likely) supping/eating some sort of delicious drink/meal.

-

Renée Zellweger was just spotted carrying the cult tote bag we've been coveting for months

Renée Zellweger was just spotted carrying the cult tote bag we've been coveting for monthsShe looked unrecognisable for a reason - and she styled this chic bag in the most perfect way

-

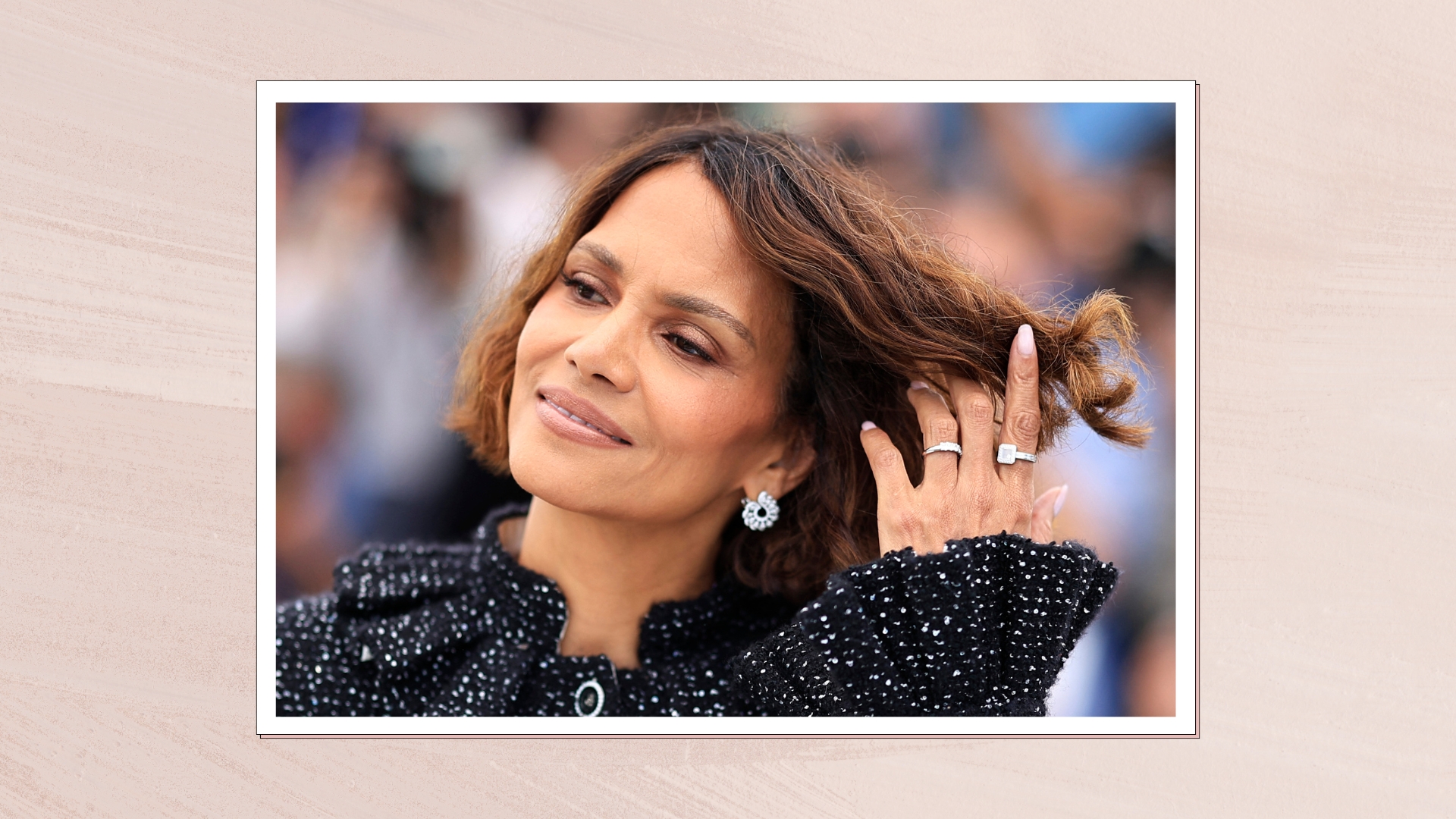

Halle Berry's sheer nails are like the Hermès bag of manicures, timeless, utterly luxe - and Beauty Ed-approved

Halle Berry's sheer nails are like the Hermès bag of manicures, timeless, utterly luxe - and Beauty Ed-approvedHalle Berry's latest manicure is simple elegance at its finest